Why the first $100,000 savings is important and why it is so difficult

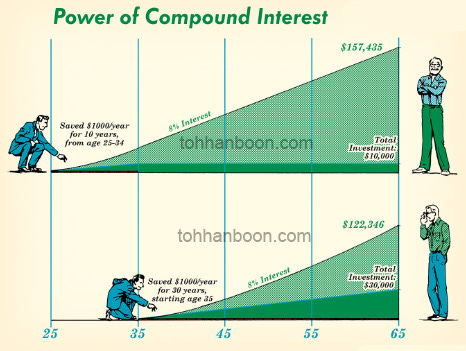

Power of compounding interests

(This is a repost from my earlier blog on January 24, 2020 that I migrated over)

I love it when value investing bloggers share their financial journeys because I always see a similar trend: It takes years to save the first $100k, but after crossing a threshold, with each passing year, the compounding interest starts pushing the principal amount higher at a faster and faster rate.

Today I want to share why your net worth will sky rocket after crossing the first $100,000 treshold and the math behind.

The first $100,000

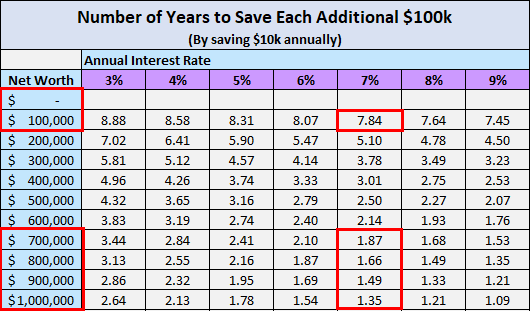

Consider our friend Josephine who saves and invests $10,000 every year. At a 7% annual interest rate, her net worth will grow to $100k in the first 7.84 years.

If Josephine continues to invest $10k per year at a 7% interest rate, she’ll be able to save her next $100k in only 5.1 years.

As time goes on, Josephine will be able to save each additional $100k in shorter and shorter amounts of time.

Although she is saving the exact same amount each year, the money she already saved is working for her behind the scenes, pushing her net worth higher at a faster rate each year.

Here is a chart that shows how long it would take to save each additional $100k (up to $2 million) based on different annual interest rates:

If we stick with the example of Josephine investing $10k each year at a 7% interest rate, there’s a mind-boggling stat to be seen: To increase her net worth from $0 to $100k, it will take her 7.84 years. But to increase her net worth from $600k to $1 million, it will only take 6.37 years.

This illustrates just how insanely powerful compound interest is once you have a few hundred thousand dollars saved up. As Charlie Munger said, getting the first $100k is a bitch, but once you cross that threshold, your savings begin to do the heavy lifting for you. This is the main reason why saving the first $100,000 is important.

Notice in the chart above that it takes 7 – 8 years to save the first $100k no matter what annual interest rate your savings grows at. This is because the amount you save matters far more than your investment returns when you’re just starting out.

As an additional resource, here’s a chart that shows how long it will take to save each additional $100k based on different annual savings. This chart assumes a 7% annual interest rate on investments.

The Math Works at Every Level

Saving $10k per year at a 7% interest rate is just a hypothetical scenario I chose to explore here. The math holds true for every amount of savings and every interest rate, though. As time goes on, your net worth will ramp up faster and faster each year due to compound interest.

Unfortunately, the magic of compound interest doesn’t tend to reveal itself until you cross the $100k net worth mark. This is the reason why saving the first $100,000 is important. It’s around that point that you have enough savings for interest to have a noticeable impact.

There’s an important lesson to be learned here: Don’t be discouraged if it takes you longer than you hoped to save your first $100k. This is by far the most difficult $100,000 to save and will likely take you the longest to save. But once you cross that point, the road only gets easier from there.

I should also highlight that I didn’t account for any increases in income in the scenario above. More than likely, as you get older your income will increase, which means you’ll be able to save more and more each year. This increased savings combined with compound interest will help you increase your net worth even faster than what these charts show.

Hope 2020 will be a prosperous year – the year where you can save your first $100,000, or if not, the year to start your investing and savings journey!